For a lot of us (including myself), what better day is there than payday? It’s easy to see that money hit your account and want to spend it frivolously. However, as we are trying to build wealth, this is obviously not what we do with our money…right? Budgeting and saving while balancing all incoming bills can pose a serious challenge for a lot of us.

While many people have their own saving and budgeting strategies, I’m going to pose another option, one that I use myself – the 75/15/10 strategy. This is a well-known strategy used to guarantee that with every paycheck, you are always saving and investing while still having money for everyday expenses.

What is the 75/15 10 Budget?

This strategy suggests allocating percentages of your paychecks to your everyday expenses, investments, and savings. Let’s dive a little deeper into exactly what the percentages are, if you haven’t already guessed:

75% for everyday expenses:

Setting aside a majority of your paycheck still allows you to prioritize paying your bills and supplying for any everyday needs you may have. Granted, for some of us, 75% of our current income may not be enough to supply for our current everyday needs, but we’ll touch on that later.

15% for investments:

Once you’ve set aside the money you need for everyday expenses, it’s time to start thinking about how to grow your remaining money. Finding different investment opportunities, whether it be stocks, real estate, or other business investments, is one of the best ways to see your money grow over time. Now, it’s important to make sure you’re investing in things worthwhile and not just throwing your money away. If you’re interested in learning more about investing, let me know. I’d be happy to make some more content about it!

10% for savings:

The final 10% of this income allocation strategy is designated for your savings. The idea behind making the savings allocation the smallest is to encourage growth. I have said this before, but stagnant money DOES NOT GROW. Allowing yourself to put slightly more into active investment rather than into your savings helps to potentially bring more value to the money coming in with every paycheck. Now, this is not to say that savings accounts are useless. You definitely should always be saving money and building those savings accounts. That 10% you are putting away every month can be saved for a rainy day or can even be used to make major purchases in the near or distant future!

Pros of the 75/15/10

This budget allocation is good for those who wish to be more aggressive with their excess money. If you are somebody who wants to see your money grow, then this budget guarantees you will have some sort of budget to play with different investments every paycheck. If we’re talking about stocks, consistent investment is the key to growth. I’m personally a big ABB (Always Be Buying) and buy-and-forget type of investor in stocks, so having access to a constant flow of funds is crucial to building those returns over time.

Another benefit to this type of budget is that it allows for a large portion of money to still be used for everyday expenses. For those who either have a lot of expenses that eat at their paycheck or those who like a little bit of extra change in their pocket, this budget is more lenient. Other budget structures demand much stricter allocation to everyday expenses. This may not work for those with a lot of expenses or those who haven’t submitted to frugality yet. If you haven’t yet, it’s not too late to change!

The final benefit to this budget is its simplicity. It’s very straightforward to understand and implement to your own finances. I’ll dive deeper into an example of how to implement this strategy to your own finances a little later in this post, so read until the end if you’re still curious how it works.

Cons of the 75/15/10

While there are tons of pros to the 75/15/10, there are definitely a few cons that should be considered as well.

First, this budget only works if your expenses can be condensed into 75% of your income. For some of us with a lot of debt or too many expenses, it may not be feasible to limit yourself to only 75% of your income. If this is the case, then you should first start trying to tackle your debt and critically thinking about ways to lower your everyday expenses. Pro tip: Look at your subscriptions; you’ll be surprised how much you spend on unnecessary subscriptions each month. They really add up!

Next, this budget does not allow for very aggressive savings. While guaranteed to build your savings through regular allocation constantly, 10% income may not be enough for those with aggressive savings goals or those who are saving for specific, potentially expensive purchases.

The last major con of this budget is that it typically works better for those with consistent paycheck amounts or salary-based jobs. The rigidity of this budgeting strategy works okay if the income is regulated and it is easy to anticipate what paychecks will look like. But for those who work in hourly jobs or tip-based salaries, this budget can be difficult because 75% of your living budget can fluctuate paycheck to paycheck.

How to Implement the 75/15/10

Implementing this budget to your own finances is pretty straightforward. Here, I’ll give you an example with some real numbers so you can get a better understanding of this budget in practice.

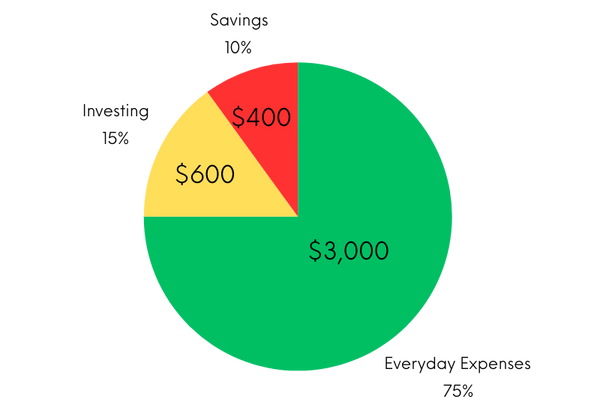

Let’s say that with every paycheck, you can expect to make $4,000. The distribution would be as follows:

Now that you have your distribution calculated, you will need to decide if $3,000 is enough for you to live off of and if $400 is enough of a savings for you every paycheck. Like I said earlier, if you decide that 75% is not enough to support yourself, then try cutting out some expenses. Cutting out expenses is a great way to put some money back in your pocket every month.

If you decide that the 10% savings is not enough for you, then try adjusting the percentages. You can always adjust some of these allocations to better fit your needs. Try taking some of your everyday expense allocation and moving it to your savings. Maybe you can transfer some of your investing allocation back into your savings. These percentages are not set in stone, it’s okay to change allocations as you see fit. The general idea of this budget is to allocate a regulated amount of your income to each of these three pillars so that you are always tracking your money. Staying on top of your money and making sure every dollar has a purpose is crucial to building healthy finances.

Good Luck!

This budgeting strategy is one of many. For some, the 75/15/10 may be just what you need to take the next step in your personal finance journey. For others, this style of budgeting may not be a good fit, and that’s totally fine! What may work for one person may not work for another.

I encourage you to try the 75/15/10. Try it for a few weeks or months and see if you notice any improvement in your finances. I currently use this budgeting strategy, and it works really well for me. I hope you find some success with it, and if you do, I’d love to hear about it. Leave a comment about some other strategies you are trying or recommend. I’m always interested in learning new ways to budget and manage my money. Best of luck!