What is Credit Utilization Ratio?

Has this ever happened to you? You’re staying on top of your credit cards, making sure you’re paying them off on time, and even making sure you’re not carrying over a balance because you’re trying really hard to work on your credit score. Then you check your score and it dropped seemingly for no reason. This happened to me a few weeks ago and I couldn’t understand why my score dropped. It didn’t drop much, but it dropping at all was definitely a bit frustrating. After that, I was determined to figure out what could’ve caused it, and that’s when I first heard about credit utilization. I was shocked I had gone this long without knowing what this was, and how to fix it. I figured I must not be the only one who wasn’t aware that credit bureaus check this, so here is my attempt to help you understand what credit utilization is. It’s actually more important than you think.

Understanding your credit utilization ratio is actually quite simple, and maintaining healthy utilization is one of the easiest ways to boost your credit score! In its simplest form, your credit utilization ratio is the percentage of your available credit that you’re currently using. Think of it as a financial report card that shows lenders how much of your credit card “allowance” you’re spending.

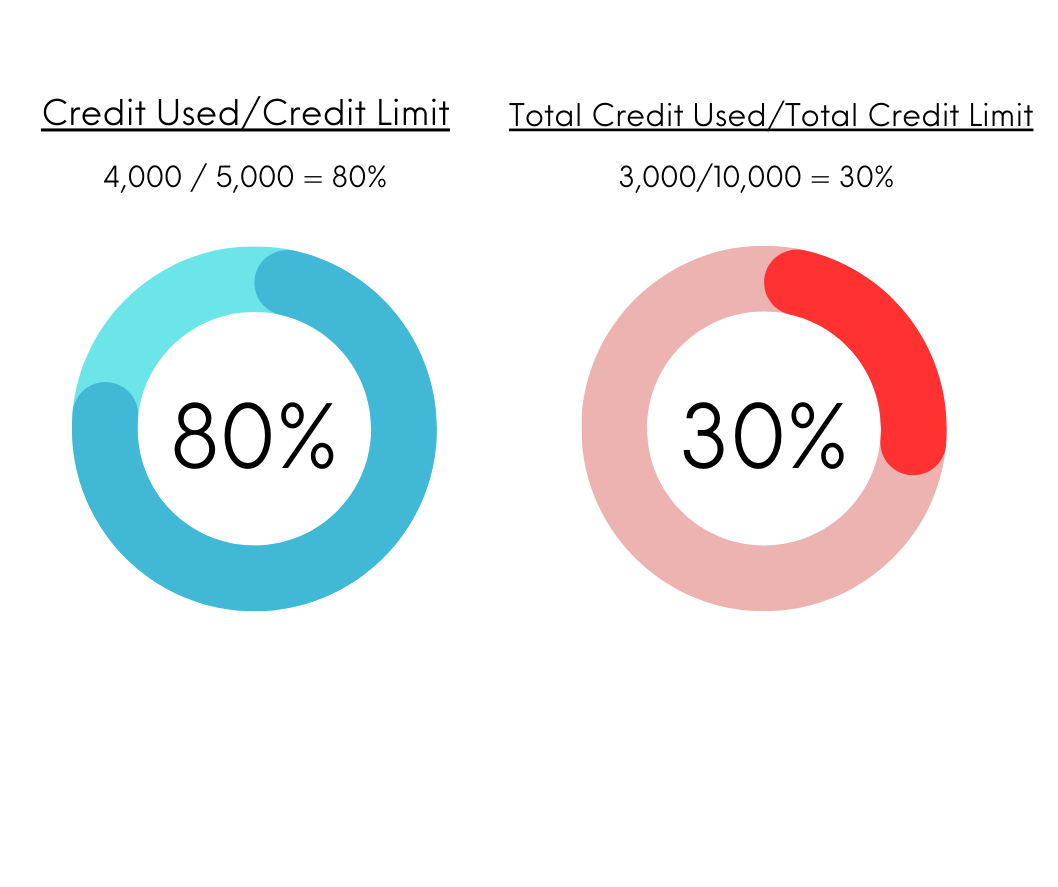

Here’s the basic formula: Take the total amount you owe across all your credit cards and divide it by your total credit limits. For example, if you have two credit cards with limits of $5,000 each (so $10,000 total), and you’re carrying balances of $2,000 and $1,000 (totaling $3,000), your credit utilization ratio would be 30% ($3,000 ÷ $10,000 = 0.30 or 30%).

But here’s where it gets interesting – credit bureaus actually look at your utilization in two different ways.

First, they consider your per-card utilization. Let’s say you have that same $5,000 limit card but you’ve charged $4,000 on it – that’s an 80% utilization on that individual card, which can raise red flags with lenders even if your overall ratio is lower. This is why spreading your charges across multiple cards can sometimes be smarter than maxing out a single card.

The second way is your overall utilization across all cards, which we calculated earlier. Both matter, but many experts suggest that your overall utilization carries more weight in credit scoring models. Here’s a visual for you, the left shows a potential utilization ratio for a single card, and the right shows utilization across all cards and credit limits:

Why does this ratio matter so much? Well, it’s essentially a snapshot of your credit management skills. High utilization can signal to lenders that you might be struggling to manage your credit or relying too heavily on your cards. On the other hand, low utilization suggests you’re using credit responsibly and have plenty of breathing room in your budget. That’s why maintaining a healthy credit utilization ratio is absolutely crucial for your credit health!

Ideal Credit Utilization: Breaking Down the Numbers

If there’s one thing you remember from this whole post, remember the number 30. Many people believe 30% is the threshold you want to stay under to maintain good credit utilization. However, try to get it lower if you can, many credit experts agree that the lower your utilization, the better your credit score potential (well, to a point – but we’ll get to that!).

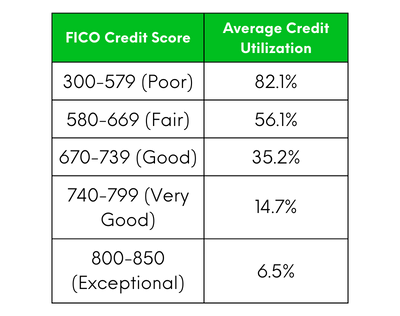

Data from FICO shows that consumers with the highest credit scores (800+) have utilization averages of about 11.5%! One of the best pieces of advice I’ve ever received is to live like the top percent, and eventually, you’ll get there. So, if FICO says the top credit scores have utilization rates that low, then maybe we should, too.

Now I know you’re probably thinking, “Well if we want our utilization as low as possible then I’ll just keep it as zero. Can’t get any lower than that!” but of course, it’s not that simple. Because why would it be? Most credit scoring models actually prefer to see some activity on your cards. Why? Because they want to see how you manage credit, not how well you can avoid using it. It’s like having a driver’s license but never getting behind the wheel – sure, you’re not risking any accidents, but you’re not proving you can drive either.

Here’s a little table I put together using information provided by FICO showing average credit utilization and corresponding FICO credit scores:

Now, don’t panic if you’re above these ranges! Your credit score doesn’t suddenly plummet the moment you cross 30% utilization. The key takeaway from this is to stay under 30% and you should be fine, get even lower and you should be great! …But don’t NOT use the card.

If you haven’t been doing this already, no worries, your credit score can recover from high utilization. Unlike other credit factors that might take months or years to improve (I’m looking at you, late payments!), your utilization ratio resets each month when your statement closes.

Strategies to Lower Your Credit Utilization

Now how exactly are we going to lower our utilization? While I know we are all guilty of putting a few more purchases on our cards than we maybe should, I’m also aware there are some expenses we can’t avoid. Here are some things I do myself, and maybe you should consider:

Pay throughout the month: This one is easy. Use the card for purchases you can afford to make with a debit card (aka things you can actually afford), then make multiple payments throughout the month to keep the utilization low. This is especially useful if you’re making a large purchase that would temporarily spike your utilization.

The reason why this works is because most credit card issuers report your balance to the credit bureaus on your statement closing date. This means, if you cut that balance before the closing date, then your reported utilization will be lower.

Credit Limit Increases: Now, let’s talk about asking for credit limit increases. I only recommend this if you know you are responsible with your card. If you think a higher limit will just entice you to spend more, then maybe this isn’t the move for you. But here’s the thing: if you’ve been making on-time payments and it’s been a decent bit of time since your last increase, many issuers will gladly bump up your limit. Just a quick phone call could potentially cut your utilization ratio in half!

Have Different Cards For Different Uses: Honestly, I recommend this even outside of utilization purposes (I will be writing a post about this too). Having multiple cards for different purposes such as a travel card, a card for everyday purchases, or even a card for rent helps you to increase your overall credit limit, and also prevents you from putting all your transactions on one card and spiking that ratio.

Monitoring and Maintaining Your Credit Utilization

Let’s say you’ve decided that what I’m saying makes some sense and you want to try make some changes to how you’re using your credit cards. Especially in the beginning when you are trying to break old habits, it’s a lot easier to adjust when you have systems to help you do it. Here are a few things that might make it easier:

Turn. On. Alerts!: Most credit card apps let you set up custom alerts on your phone for a variety of things. You can set alerts for when your balance hits certain thresholds – say, 20% of your credit limit. This way, you’ll get notified when you’re reaching the point where you should consider either laying off on the card for a bit or paying some of that balance. You can even set up text alerts for every purchase, which is super helpful for catching any unauthorized charges (and keeping yourself honest about that late-night online shopping!).

If you’re using Chase follow these steps to set up alerts:

Profile & Settings > Alerts > Choose Alerts, then select the different alerts you want to turn on.

Other banks might have a slightly different way to do this, but a simple google search will usually give you straightforward directions to set this up.

Set Up a Calendar: This is something you might already do to stay on top of payments, but might as well mention it. Marking the statement closing date or maybe a few days before that day can help you to keep on top of when your utilization will be reported (remember, the statement closing date is different from your due date).

It’s All About Progress

Real talk: managing your utilization isn’t about perfection – it’s about progress. Whether you’re starting with sky-high utilization or just fine-tuning what you’ve got, every step counts.

The best part? You’ve got the power to change your utilization almost instantly! Unlike other credit factors that are much harder to fix like credit card debt (which I will likely make a post about in the future so stay on the lookout!). I know there’s a lot of information here, but if you’ve made it this far I really appreciate you taking your time to let me ramble.

I know finances can be hard, and sometimes overwhelming. It’s something I’m still learning and by no means claim to be an expert on. However, being able to navigate the complexities of personal finance can seriously change your life. These credit card companies win when you don’t know how to use the cards they give you. It may take some time, but if you push yourself to make a few changes here and there every month you are bound to see improvements. Just remember to never give up on your financial goals. Stay steadfast, and disciplined and I know you’ll get there.

Let me know how you’re progressing. If any of what I said was helpful I’d love to hear about it. See you next week for my next post! Good luck! 💪